Sub-Saharan Africa Emerges as World’s Third-Fastest Growing Crypto Economy

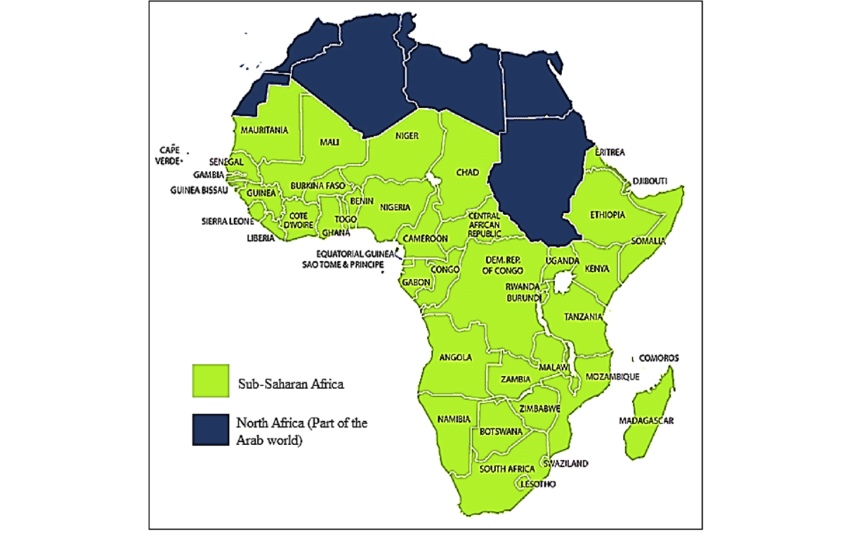

Nairobi, Kenya – Sub-Saharan Africa has solidified its position as the world’s third-fastest growing cryptocurrency market, recording a 125% year-over-year increase in digital asset adoption despite macroeconomic challenges and evolving regulatory landscapes. According to the 2025 Chainalysis Global Crypto Adoption Index, the region now trails only Southeast Asia and Latin America in grassroots cryptocurrency integration, with Nigeria, Kenya, and Ghana leading this remarkable expansion.

The growth—driven by currency volatility, remittance innovation, and youthful demographic adoption—signals a fundamental shift in how Africans preserve wealth, conduct business, and participate in the global digital economy. Here’s an in-depth analysis of the trends, drivers, and implications of Africa’s crypto acceleration.

Key Growth Metrics and Regional Ranking

Global Crypto Adoption Index 2025

- Southeast Asia – 145% YoY growth

- Latin America – 132% YoY growth

- Sub-Saharan Africa – 125% YoY growth

- Middle East & North Africa – 98% YoY growth

- Eastern Europe – 85% YoY growth

Sub-Saharan Africa Standout Metrics

- Total transaction volume: $117.2B (up from $52.1B in 2024)

- Retail-dominated activity: 95% of transactions under $1,000

- Mobile-first access: 78% of users exclusively via smartphones

- Cross-border focus: 62% of volume for international payments

Country-Level Performance Breakdown

Top Performers by Transaction Volume

| Country | Growth YoY | Key Drivers |

|---|---|---|

| Nigeria | 142% | Currency volatility, tech adoption |

| Kenya | 128% | Remittance innovation, mobile money integration |

| Ghana | 119% | Youth adoption, inflation hedging |

| South Africa | 93% | Institutional entry, regulatory clarity |

| Angola | 156% | Oil revenue diversification, payment alternatives |

Emerging Markets Showing Promise

- Ethiopia: 185% growth following telecom liberalization

- DR Congo: 134% growth amid mineral trading innovation

- Zimbabwe: 201% growth driven by hyperinflation protection

Primary Growth Drivers

1. Currency Volatility Protection

- Naira volatility: 45% depreciation against USD in 2024

- Zimbabwean hyperinflation: 320% annual inflation rate

- Ghanaian cedi: 30% decline prompting dollar alternatives

2. Remittance Revolution

- Cost reduction: Crypto remittances 60% cheaper than traditional channels

- Speed improvement: 10-minute settlements vs. 3-5 banking days

- Mobile integration: Direct to M-Pesa, Airtel Money, MTN Mobile Money

3. Youth Demographic Adoption

- Median age: 18.7 years across region

- Tech literacy: 65% smartphone penetration among 15-35 cohort

- Entrepreneurial use: 42% of SMEs accept crypto payments

4. Regulatory Progress

- Nigeria: Clear digital asset classification framework

- Kenya: Capital Markets Authority sandbox licensing

- Mauritius: Digital Asset Licensing regime attraction

Unique African Adoption Patterns

Mobile-First Accessibility

- Feature phone integration: USSD-based trading via *867# codes

- Zero-data solutions: SMS-based wallet management

- Offline functionality: Mesh network transaction broadcasting

Stablecoin Dominance

- USDT volume: 68% of all crypto transactions

- Local innovations: Nigeria’s cNGN, Kenya’s proposed e-shilling

- Remittance corridors: USDT->Mobile Money automated conversion

P2P Market Innovation

- Informal exchange integration: 35% of trades via social media channels

- Community trust systems: WhatsApp-based verification networks

- Cross-border arbitrage: 15-25% price differences between countries

Sector-Specific Adoption Trends

Agriculture

- Tokenized commodities: $250M in crop-backed digital assets

- Supply chain finance: 22% faster payments to farmers

- Export documentation: Blockchain-based certification

Remittances

- Diaspora volumes: $65B annually, increasingly crypto-mediated

- Cost reduction: From 8.9% average to 3.2% via crypto channels

- Integration: 62% of mobile money wallets now crypto-compatible

SME Commerce

- Payment acceptance: 38% of formal SMEs accept stablecoins

- Inventory financing: Crypto-collateralized working capital loans

- Cross-border trade: 45% reduction in settlement time

Regulatory Landscape Evolution

Progressive Jurisdictions

- Mauritius: Digital Asset License attracting $300M in investments

- Rwanda: Sandbox environment with 45 participating projects

- Botswana: Virtual Asset Act enabling licensed exchanges

Developing Frameworks

- Nigeria: SEC guidelines providing clarity on asset classification

- Kenya: Capital Markets Authority drafting comprehensive rules

- Ghana: Bank of Ghana piloting regulatory sandbox

Restrictive Environments

- Zambia: Complete ban on crypto trading activities

- Ethiopia: Limited to licensed mining operations only

- Lesotho: No formal recognition of digital assets

Infrastructure Development

Exchange Growth

- Registered platforms: 42 licensed exchanges across region

- Trading volume: $18.2B monthly spot trading

- Liquidity depth: 25% improvement in market makers

Wallet Innovation

- Non-custodial adoption: 68% of users control private keys

- Multi-currency support: Integrated traditional and digital assets

- Security enhancements: Biometric authentication standardization

Banking Integration

- On-ramps: 35% of commercial banks offer crypto services

- Off-ramps: Automated conversion to local currencies

- Custody services: Licensed digital asset storage solutions

Challenges and Risk Factors

Volatility Management

- Stablecoin depeg events: 3 incidents affecting $12M in value

- Liquidity constraints: 15-30% price premiums during high demand

- Arbitrage limitations: Regulatory barriers to cross-border flow

Security Concerns

- Phishing attacks: $7.3M in losses Q2 2025

- Exchange hacks: 2 major incidents affecting 23,000 users

- Social engineering: 65% of losses from SIM swap attacks

Regulatory Uncertainty

- Tax treatment: Unclear capital gains application

- Banking access: 40% of users report account closures

- Legal status: Inconsistent definitions across jurisdictions

Future Projections and Trends

2026 Growth Expectations

- Adoption rate: 85-110% continued growth

- Volume projection: $200B+ total transaction value

- User base: 45 million active crypto participants

Technology Developments

- Lightning Network integration: For low-value daily transactions

- CBDC interoperability: National digital currency bridges

- AI-enhanced security: Behavioral fraud detection systems

Market Evolution

- Institutional entry: Asset managers allocating 1-3% to digital assets

- Derivatives growth: Futures and options markets development

- Tokenization expansion: Real-world asset representation on-chain

Strategic Implications

For Users

- Financial inclusion: Access to global financial system

- Inflation protection: Dollar-denominated asset exposure

- Cost reduction: Significantly cheaper financial services

For Businesses

- New markets: Access to global customer base

- Efficiency gains: Faster settlement and reduced friction

- Innovation opportunities: Blockchain-based business models

For Governments

- Economic growth: Digital economy expansion

- Revenue collection: Taxable transaction volume increase

- Financial integration: Improved cross-border trade efficiency

To learn how your business can benefit from customized financial solutions, visit MUIAA Ltd. MUIAA offers expert guidance on funding opportunities both for personal and business. Contact us today for personalized support in meeting your business needs within Kenya’s evolving digital economy.