Nairobi’s First Bitcoin ATM Arrives at Two Rivers Mall: What It Means for Crypto Adoption in Kenya

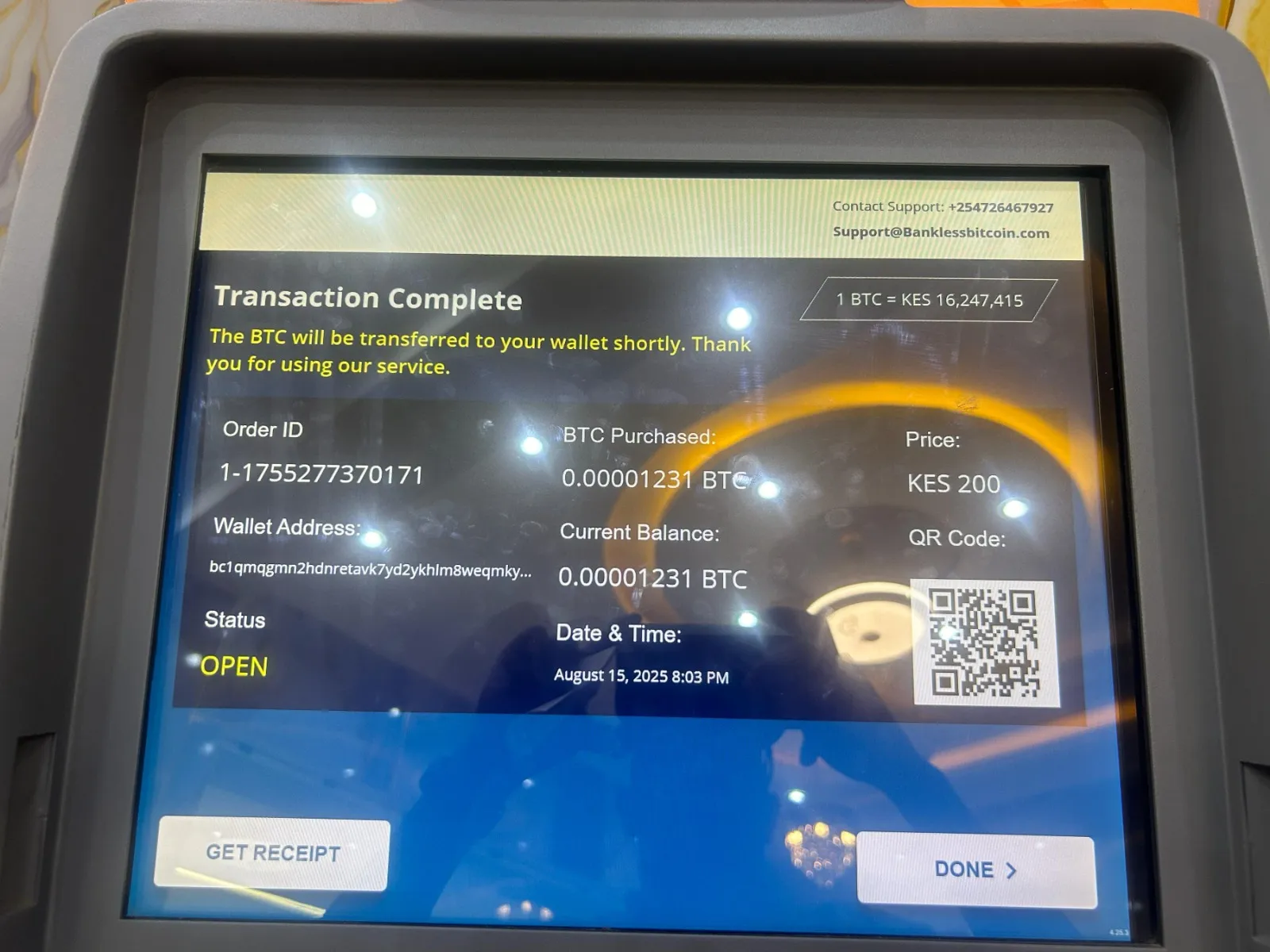

Nairobi, Kenya – In a significant step toward mainstream cryptocurrency adoption, Bankless Bitcoin is set to launch Nairobi’s first-ever Bitcoin ATM at Two Rivers Mall, offering residents and visitors a seamless way to buy and sell Bitcoin using Kenyan shillings. The move marks a pivotal moment in Kenya’s digital currency journey, bridging the gap between traditional finance and the burgeoning crypto economy.

Scheduled to go live on September 15, 2025, the ATM will provide a tangible, user-friendly gateway into the world of Bitcoin, catering to both beginners and seasoned traders. But what does this mean for Nairobi’s financial landscape? How does it work? And what should users know before diving in? Here’s a detailed breakdown.

ATM Overview: Features and Functionality

Key Specifications

- Model: Genesis Coin Athena

- Supported Cryptocurrency: Bitcoin (BTC) only

- Supported Fiat: Kenyan shillings (KES)

- Transaction Types: Buy and sell Bitcoin

- Transaction Limits:

- Minimum: KSh 2,000

- Maximum: KSh 200,000 per day

- Transaction Speed: Under 90 seconds

User Experience

- Intuitive Interface: Touchscreen with step-by-step guidance

- Wallet Integration: Supports QR code scanning for seamless transfers

- Paper Wallet Option: Generate a paper wallet for offline storage

- SMS Receipts: Instant transaction confirmations via text

Fees and Costs: What to Expect

Fee Structure

- Buying Bitcoin: 7.5% fee + network miner fees (≈ KSh 350)

- Selling Bitcoin: 5.5% fee + network miner fees (≈ KSh 210)

Why the Premium?

- Operational costs (rent, security, maintenance)

- Regulatory compliance requirements

- Instant liquidity provision

Compared to Alternatives

- Local Exchanges: Lower fees (3–4%) but slower bank processing

- P2P Platforms: Variable rates and potential counterparty risks

- International Services: High forex conversion costs

Regulatory and Security Measures

Compliance Framework

- Licensed by the Central Bank of Kenya (CBK) as a Money Remittance Bureau

- Adheres to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations

- Conducts mandatory identity verification for transactions above KSh 50,000

Security Protocols

- Biometric Verification: Facial recognition for returning users

- Encrypted Data Storage: No personally identifiable information (PII) retained

- Physical Security: 24/7 surveillance and time-locked safes

- Blockchain Transparency: All transactions are publicly verifiable

Target Audience and Use Cases

For Beginners

- Easy entry into Bitcoin without technical expertise

- No need for bank accounts or online exchange registrations

- Educational resources available on-screen

For Tourists and Diasporas

- Convert foreign currency to Bitcoin effortlessly

- Avoid high forex fees and slow international transfers

For Savvy Traders

- Quick arbitrage opportunities against local exchanges

- Instant liquidity for buying or selling Bitcoin

Strategic Importance for Kenya

Financial Inclusion

- Provides access to digital assets for the unbanked population

- Democratizes Bitcoin ownership beyond tech-savvy urbanites

Economic Implications

- Positions Kenya as a leader in Africa’s crypto adoption

- Attracts international crypto businesses and investments

Regulatory Precedent

- Sets a benchmark for future crypto ATM deployments in Africa

- Encourages clearer regulatory guidelines for digital assets

Potential Challenges

Volatility Risks

- Bitcoin’s price fluctuations could impact user experience

- ATM exchange rates may lag during market volatility

Technical Hurdles

- Power outages and internet connectivity issues

- Potential software glitches or hardware malfunctions

User Awareness

- Need for public education on Bitcoin basics and security

- Risk of phishing scams or fraudulent transactions

Looking Ahead: The Future of Crypto ATMs in Kenya

Expansion Plans

- Additional ATMs planned for Westgate Mall, Sarit Centre, and Mombasa

- Potential integration of Lightning Network for faster, cheaper transactions

Market Predictions

- Increased competition among crypto ATM providers

- Gradual reduction in fees as adoption grows

- Possible integration with mobile money platforms like M-Pesa

Long-Term Vision

- Kenya as a hub for crypto innovation in East Africa

- Enhanced interoperability between traditional finance and digital assets

How to Use the Bitcoin ATM: A Step-by-Step Guide

- Prepare Your Wallet

- Download a Bitcoin wallet (e.g., Trust Wallet, BlueWallet)

- Generate a receiving address or QR code

- Verify Your Identity

- Provide your phone number for SMS verification

- Complete biometric registration (for larger transactions)

- Insert Cash or Scan QR Code

- For buying Bitcoin: Insert cash and scan your wallet QR code

- For selling Bitcoin: Send Bitcoin to the ATM’s address and receive cash

- Confirm and Collect

- Review the transaction details on-screen

- Collect your cash or wait for Bitcoin confirmation

Final Remarks

The launch of Nairobi’s first Bitcoin ATM is more than just a convenience—it’s a symbol of Kenya’s growing embrace of digital currencies. While challenges remain, this development paves the way for broader adoption, financial inclusion, and innovation. As Bankless Bitcoin leads the charge, all eyes will be on how Kenyans respond to this new frontier in finance.

To learn how your business can benefit from customized financial solutions, visit MUIAA Ltd. MUIAA offers expert guidance on funding opportunities both for personal and business. Contact us today for personalized support in meeting your business needs within Kenya’s evolving digital economy.