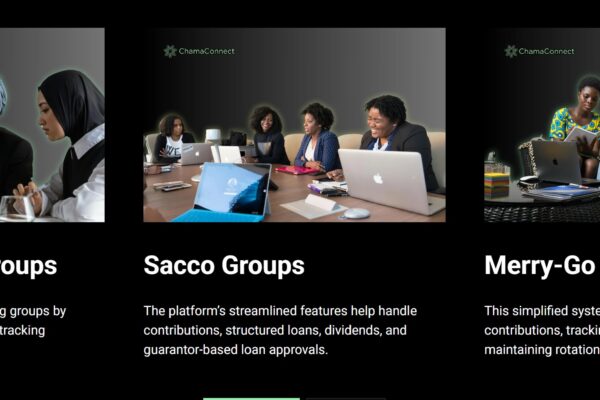

ChamaConnect: The Blockchain-Powered Future of Chama & SACCO Banking

Say Goodbye to Manual Record-Keeping—Hello to Smart, Secure, & Automated Finance! In Kenya and across Africa, Chamas, SACCOs, and merry-go-round groups have long been the backbone of community savings and financial empowerment. But despite their importance, many still struggle with manual bookkeeping, lost records, loan disputes, and transparency issues—problems that can erode trust and slow…