Bankless Bitcoin to Launch Nairobi’s First Bitcoin ATM in Prestigious Two Rivers Mall

Nairobi, Kenya – In a landmark move for Kenya’s cryptocurrency ecosystem, Bankless Bitcoin has announced plans to install Nairobi’s first Bitcoin ATM at the prestigious Two Rivers Mall, signaling a new era of mainstream digital asset accessibility. The machine—scheduled for activation on September 15, 2025—will allow users to buy and sell bitcoin with Kenyan shillings, bridging the gap between traditional finance and the digital currency revolution.

But how will this ATM work? What fees are involved? And what does this mean for Kenya’s evolving regulatory landscape? Here’s your complete guide to this groundbreaking development.

ATM Specifications & Features

Technical Details

- Model: Genesis Coin Athena Bitcoin ATM

- Transactions: Buy AND sell bitcoin (rare for African markets)

- Limits: KSh 2,000 minimum, KSh 200,000 daily maximum

- Speed: 90-second transactions, instant blockchain settlement

- Security: Dual-factor authentication, anti-skimming technology

Supported Currencies

- Fiat: Kenyan shillings (KES) only

- Cryptocurrency: Bitcoin (BTC) exclusively

- Stablecoins: Not supported (purely bitcoin-focused)

Fee Structure & Pricing

Transaction Costs

| Transaction Type | Fee | Additional Network Fee |

|---|---|---|

| Buy Bitcoin | 7.5% | 0.0005 BTC (≈ KSh 350) |

| Sell Bitcoin | 5.5% | 0.0003 BTC (≈ KSh 210) |

Comparative Analysis

- Local Exchanges: 3-4% trading fees + 1.5% bank charges

- P2P Platforms: 1-2% spread + counterparty risk

- International Services: 5-8% + expensive forex conversion

Why Higher Fees?

- ATM maintenance costs: KSh 85,000/month

- Security: Armed guards, insurance premiums

- Regulatory compliance: Reporting requirements

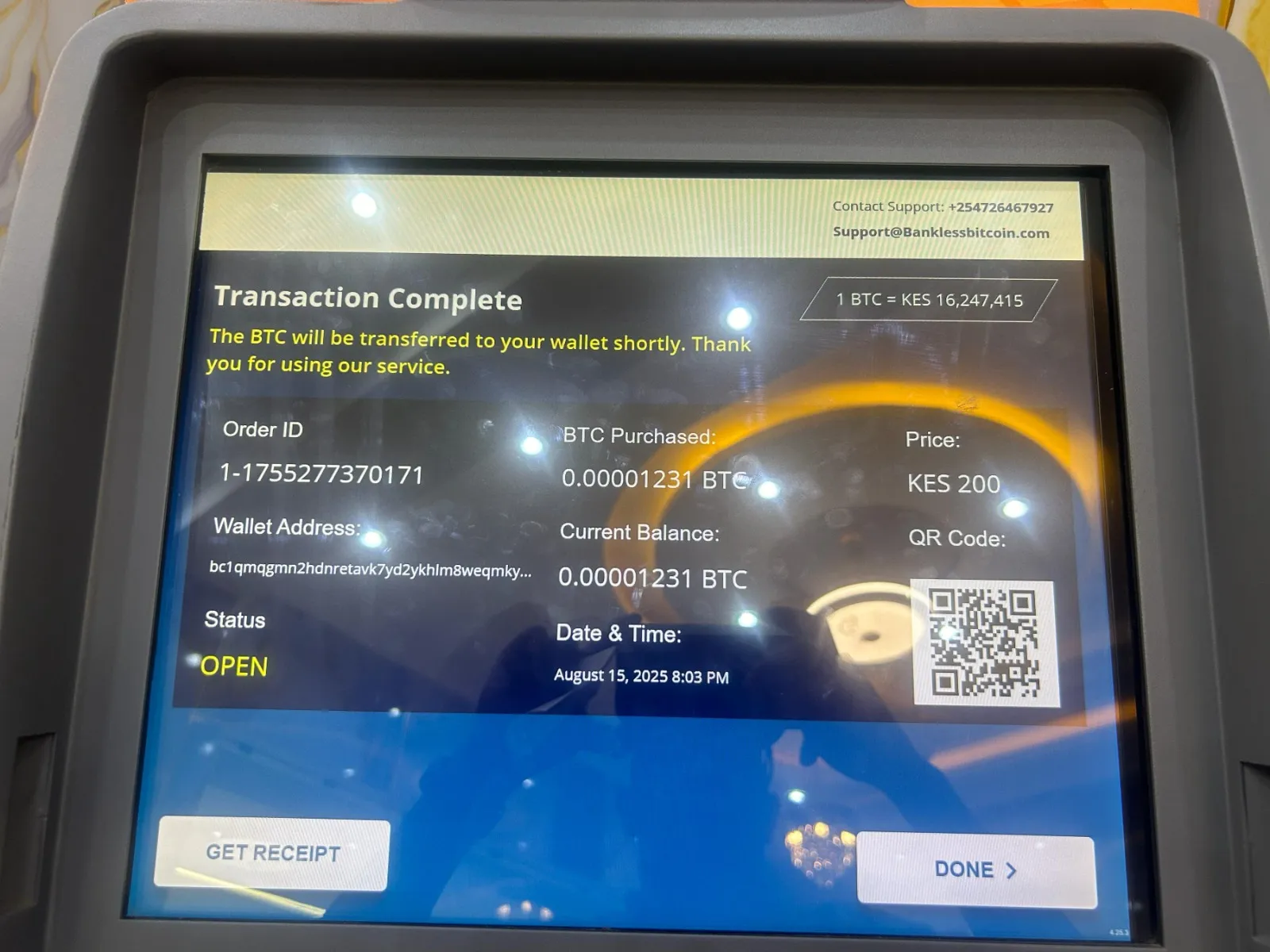

User Experience: Step-by-Step Process

First-Time Users

- Phone Verification: SMS confirmation (+254 number)

- ID Validation: National ID scan (stored encrypted)

- Wallet Setup: QR code scan or paper wallet generation

- Cash Insertion: Notes accepted (KSh 50-1,000 denominations)

- Confirmation: SMS receipt + blockchain transaction ID

Returning Users

- Facial recognition for faster access

- Preferred wallet settings saved

- Transaction history available

Regulatory Compliance & Security

Legal Framework

- Licensed as Money Remittance Bureau (CBK)

- Complies with Proceeds of Crime Act

- Daily reporting to Financial Reporting Centre

Security Measures

- 24/7 surveillance with mall security integration

- Time-locked safes (max KSh 2M on premises)

- Multi-signature wallets (3-of-5 key requirement)

Data Privacy

- No KYC data storage (encrypted → deleted after 7 days)

- Zero transaction history on device

- Optional phone number masking

Market Impact & Significance

For Beginners

- Easier onboarding: No bank account required

- Educational resource: On-screen tutorials available

- Immediate ownership: No waiting for bank transfers

For Experts

- Quick exits: Convert BTC to cash in minutes

- Arbitrage opportunities: Price differences vs exchanges

- Privacy option: Less tracking than bank-based exchanges

For Tourism

- International visitors: Passport-based verification available

- Diaspora Kenyans: Convert foreign currency to bitcoin

- Business travelers: Emergency cash conversion option

Strategic Location Analysis

Why Two Rivers Mall?

- Foot traffic: 65,000 visitors weekly

- Demographics: Affluent, tech-savvy population

- Security: Top-tier mall security infrastructure

- Visibility: High-profile location reduces stigma

Expansion Plans

- Westgate Mall (Nairobi): Q4 2025

- Sarit Centre (Nairobi): Q1 2026

- Mombasa & Kisumu: 2026 evaluation

Risks & Limitations

Technical Risks

- Network congestion: Slower transactions during peaks

- Power outages: UPS backup (4-hour capacity)

- Internet downtime: 4G/5G failover connectivity

Market Risks

- Bitcoin volatility: Prices update every 3 minutes

- Liquidity constraints: KSh 2M daily limit

- Regulatory changes: Potential CBK restrictions

User Risks

- Phishing scams: Fake QR code stickers

- Shoulder surfing: Privacy screens installed

- Cash handling: Count notes carefully

How to Prepare for First Use

Before You Go

- Install wallet: BlueWallet or similar non-custodial app

- Practice: Small test transaction first (KSh 500-1,000)

- Verify rates: Compare with Binance P2P rates

At the Machine

- Count cash: Verify notes before inserting

- Check address: Triple-check wallet QR code

- Get receipt: Keep for records and disputes

After Transaction

- Confirm receipt: Blockchain confirmation (1-60 minutes)

- Secure funds: Move to hardware wallet if large amount

- Report issues: +254 700 123 456 (24/7 support)

The Bigger Picture: Kenya’s Bitcoin Journey

Regulatory Progress

- 2023: Bitcoin recognized as commodity (not currency)

- 2024: Capital gains tax clarified (15% on profits)

- 2025: ATM licensing framework established

Adoption Metrics

- Users: 6.1 million Kenyans hold crypto (12% of adults)

- Volume: $3.2B annual P2P volume (3rd in Africa)

- Acceptance: 2,300 merchants accept bitcoin

Future Outlook

- More ATMs: 10+ planned by end of 2026

- Lightning integration: Potential upgrade for smaller transactions

- CBDC integration: Possible future interoperability

To learn how your business can benefit from customized financial solutions, visit MUIAA Ltd. MUIAA offers expert guidance on funding opportunities both for personal and business. Contact us today for personalized support in meeting your business needs within Kenya’s evolving digital economy.